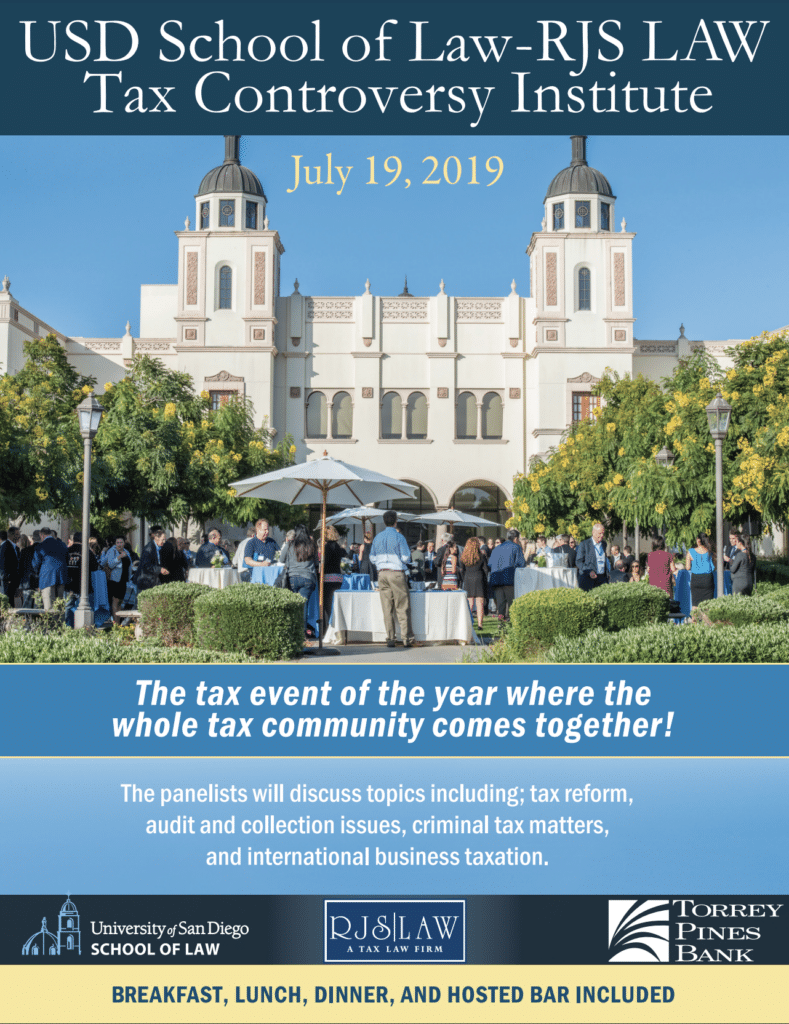

About Our San Diego, California Tax Institute

The USD School of Law – RJS LAW Tax Controversy Institute is an event held annually where the entire tax community comes together. During the conference, panelists will discuss topics including tax reform, alter ego assessments, criminal tax matters and international business and taxation. In addition, the Institute will provide practical advice from top leaders in the tax field. It will also provide phenomenal networking opportunities to meet other top practitioners including tax attorneys, CPAs, EAs and tax preparers. Learn more about our 4th annual San Diego, California tax institute below.

A Leading Educational Event For Tax Professionals

Our tax institute is a premier event where the whole tax community comes together!

Panelists discussed topics including; tax reform, audit and collection issues, criminal tax matters and international business taxation.

Our 4th Annual USD School of Law – RJS LAW Tax Controversy Institute was held on July 19, 2019 at the Joan B. Kroc Institute for Peace and Justice, Theatre at University of San Diego

Images of the 4th Annual USD School of Law- RJS LAW Tax Controversy Institute

4th Annual USD School of Law – RJS LAW Tax Controversy Institute Schedule – California Tax Institute

Location – San Diego, California Tax Institute

Joan B. Kroc Institute for Peace and Justice, Theatre 5998 Alcala Park San Diego, CA 92110

Details

The 4th Annual USD Law – RJS Law Tax Controversy Institute was held on July 19, 2019, in San Diego, CA. The Institute is the premier tax controversy event in San Diego. The region’s top tax attorneys, CPAs, and law/business school professors discused topics including passthrough planning, Wayfair, ethical pitfalls to avoid in practice, and employee classification issues in California.

Don Fort, Chief of Criminal Investigation at the IRS, kicked off the conference with introductory remarks. Panelists include:

- Caroline D. Ciraolo, Partner, Kostelanetz & Fink, LLP

- Richard Carpenter, Richard Carpenter Tax Law Office

- Sandra Brown, Principal, Hochman, Salkin, Toscher, Perez, PC

- Martin Schainbaum, Of Counsel, RJS LAW

We were honored to also have United States Tax Court Chief Judge Maurice B. Foley as the keynote luncheon speaker.

At the conference, we presented the Richard Carpenter Award to a distinguished individual who illustrates the notable achievements of Richard Carpenter honoring his 30 years of excellence in the tax field and his continued commitment to the tax community. The award is given to individuals who personify honesty, integrity, ethics, and compassion throughout his/her careers in the field of tax controversy and have demonstrated outstanding dedication and expertise while representing taxpayers before the federal and state governments.

Richard Shaw was the recipient of the 2019 Richard Carpenter Excellence in Tax Award. Mr. Shaw is a California Certified Specialist in Taxation and an attorney at Higgs Fletcher & Mack. He’s a nationally recognized business and tax lawyer and former Chair of the ABA Section of Taxation. Mr. Shaw also testifies as an expert witness and lectures nationally on business and tax issues.

The Institute provided phenomenal networking opportunities to meet other top practitioners, tax attorneys, CPAs, EAs, tax preparers, and all students were welcome to attend.

During the Tax Controversy Institute Evening Reception, Dean Stephen C. Ferruolo honored the life, legacy, and dedication of three distinguished USD law school alumni and former members of the USD School of Law Board of Visitors.

- US Attorney for the Southern District of California, Robert S. Brewer ’75 (JD,) will serve as the keynote speaker as well as the presiding officer for the ceremony.

- Gerald L. McMahon ’64 (JD) will be remembered by Seltzer, Caplan, McMahon & Vitek partner, Andrea Myers ’08 (JD)

- Craig Higgs ’69 (JD) of Higgs Fletcher & Mack will be honored by managing partner, Steven J. Cologne ’84 (JD)

Michael T. Thorsnes ’68 (JD) will be celebrated by Senior Partner, John F. “Mickey” McGuire of Thorsnes Bartolotta McGuire LLP - Michael T. Thorsnes ’68 (JD) will be celebrated by Senior Partner, John F. “Mickey” McGuire of Thorsnes Bartolotta McGuire LLP

About the University of San Diego School of Law

Each year, USD educates approximately 800 Juris Doctor and graduate law students from throughout the United States and around the world. The law school is best known for its offerings in the areas of business and corporate law, constitutional law, intellectual property, international and comparative law, public interest law and taxation.

USD School of Law is one of the 84 law schools elected to the Order of the Coif, a national honor society for law school graduates. The law school’s faculty is a strong group of outstanding scholars and teachers with national and international reputations and currently ranks 36th nationally among U.S. law faculties in scholarly impact and 22nd nationally in past-year faculty downloads on the Social Sciences Research Network (SSRN). The school is accredited by the American Bar Association and is a member of the Association of American Law Schools. Founded in 1954, the law school is part of the University of San Diego, a private, independent, Roman Catholic university chartered in 1949.

About RJS LAW

RJS LAW is San Diego and Southern California’s leading tax law firm. We are a full-service law firm that can help resolve your personal, business, and corporate tax problems with the IRS and all of California’s taxing authorities. Our practice encompasses all aspects of taxation, with an emphasis on tax controversy, tax planning, international tax, criminal tax defense, and sales tax issues. RJS LAW also maintains a vibrant Estate Planning practice providing estate planning and trust creation, as well as all aspects of probate, trust administration, and litigation.

Our office gained prominence in the San Diego community, through our diligent client representation, a history of successes, and the glowing recommendations received from our past and current clients. RJS LAW consistently appears before the Internal Revenue Service, Franchise Tax Board, Employment Development Department, and the California Department of Tax and Fee Administration. RJS attorneys also work with the Department of Justice – Tax Division, as consultants on IRS Wealth Squad audits, and with various US Attorney’s Offices throughout the country.

RJS LAW was founded by Ronson J. Shamoun, a three-time graduate of the University of San Diego, where he received his Bachelor of Arts (B.A.) in Accountancy, his Juris Doctor (J.D.), and his Master of Laws in Taxation (LL.M.) degrees. Ronson has over 20 years of experience in the field of taxation. In 2016, Ronson co-founded the annual USD School of Law RJS LAW Tax Controversy Institute – a leading educational event for tax professionals and the tax community at large to discuss current issues including newly enacted legislation, IRS initiatives and programs, criminal prosecutions, and other tax topics of interest. USD School of Law RJS LAW Tax Controversy Institute is one of a few prestigious tax institutes in the United States.