Organization for Economic Cooperation and Development OECD The Organization for Economic Cooperation and Development (OECD) has long championed a two-pillar approach to address the tax implications of digitalization and globalization. In 2025, this initiative remains at the forefront of international tax reform. While Pillar Two—introducing a 15 percent global minimum corporate tax rate—has gained traction

International Tax

Digital Services Taxes and the Risk of a Global Tax War

Digital Services Taxes The rise of digital services taxes (DSTs) has become a flashpoint in international taxation, igniting tensions between major economies. Initially introduced to address the taxation of digital revenues from companies with little to no physical presence in foreign markets, DSTs have proliferated across jurisdictions such as France, India, the United Kingdom, and

Navigating Cross-Border Tax Compliance Amid Political Shifts

Cross-Border Tax Compliance Political volatility and shifting regulatory landscapes are placing new pressures on global businesses to manage cross-border tax compliance more effectively. In particular, international reforms such as the Organization for Economic Development’s (OECD) Base Erosion and Profit Shifting (BEPS) 2.0 framework are driving sweeping changes to how multinational enterprises (MNEs) structure and report

U.S. Withdrawal from the Global Minimum Tax: Implications for Multinational Compliance and International Tax Stability

Global Minimum Tax In January 2025, President Donald Trump signed an executive order withdrawing the United States from the OECD/G20 global minimum tax framework. This agreement, supported by over 135 countries, was designed to establish a 15 percent global minimum corporate tax rate, aimed at curbing profit shifting and leveling the international tax playing field.

IRS Unveils Next FATCA IDES Testing Phase

On June 13, 2024, the IRS announced the next testing phase for the FATCA IDES. The FATCA IDES will be open for testing from Monday, July 1, 2024, to Friday, July 26, 2024. The test session will be open to users who have completed IDES enrollment by Wednesday, June 26, 2024. In order to be

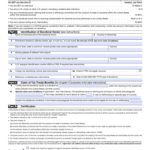

Navigating W-8 Forms: A Guide to Treaty Benefits

International Taxation In the intricate world of international taxation, one constant remains: the need for accurate reporting and compliance. This is especially true with regard to the W-8 forms, specifically W-8BEN and W-8BEN-E, which are the basis for taxpayers aiming to claim treaty benefits. The recent rise in IRS examination activity makes it crucial to

Rethinking IRS Penalty Assessments: A Deep Dive into the Farhy v. Commissioner Ruling

Farhy v. Commissioner In a recent landmark ruling, Farhy v. Commissioner, the Tax Court has significantly changed penalty assessments under I.R.C. Section 6038(b) of the Internal Revenue Code. This ruling, rendered on April 3, 2023, carries significant implications for a broad range of taxpayers, potentially offering a basis to challenge or request refunds for penalties

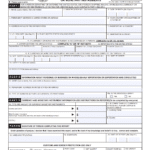

What You Need to Know About FinCEN Form 105 – Importing Currency into the United States

What You Need to Know About FinCEN Form 105 As a city with a direct border to Mexico, San Diego is a popular destination for our Mexican neighbors who need to know about the FinCen Form 105 in order to bring currency into the United States for business or personal use. Those planning to import

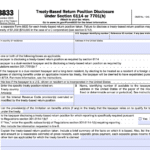

Leveraging the Benefits of Form 8833 for International Tax Treatment

The International Tax Law Team at RJS LAW receives numerous inquiries regarding a crucial yet often misunderstood element of United States tax law — IRS Form 8833, or the Treaty-Based Return Position Disclosure. For taxpayers engaged in global transactions, Form 8833 is significant as cross border transactions are often regulated by international tax treaties. What

Supreme Court Resolves FBAR Penalty Dispute: Per-Report Basis Confirmed

Introduction to the FBAR Penalty Dispute: In a significant decision, the U.S. Supreme Court recently ruled the penalty for violating the “Report of Foreign Bank and Financial Accounts” (FBAR) rules applies on a per-report basis, rather than a per-account basis. This decision brings clarity to a previously divided area of law, as the Fifth Circuit