What is a Tax Treaty? A tax treaty is an agreement between two countries intended to address and resolve issues such as double taxation of income for each country’s citizens or residents. The United States has tax treaties in place with numerous countries. These treaties seek to provide reciprocal reduced tax rates or exemptions for

International Tax Reporting

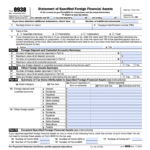

Internal Revenue Service Form 8938

An Important International Tax Form to Declare Foreign Financial Assets May be filed through the IRS Streamlined Procedures What is it Internal Revenue Form 8938? Form 8938 is used to report specified foreign financial assets when the overall value of the those specified foreign financial assets is over the appropriate reporting thresholds. The form requires