What You Need to Know About FinCEN Form 105

As a city with a direct border to Mexico, San Diego is a popular destination for our Mexican neighbors who need to know about the FinCen Form 105 in order to bring currency into the United States for business or personal use.

Those planning to import currency into the United States from any foreign country, must comply with the rules and the United States government has strict regulations governing the import of monetary instruments. Failure to comply with the rules may result in significant penalties.

What is the Currency Declaration Requirement?

The U.S. government requires all travelers bringing currency or other monetary instruments into the United States to declare currency and other instruments that equal to or exceed $10,000. This requirement applies to all travelers, regardless of citizenship or nationality.

What is Considered Currency?

For purposes of the currency declaration requirement, currency includes any coins or paper money, as well as traveler’s checks, money orders, and other monetary instruments such as bearer negotiable instruments, bearer investment securities, bearer securities, and/or stock on which title is passed on delivery.

How to Declare Currency – FinCEN Form 105

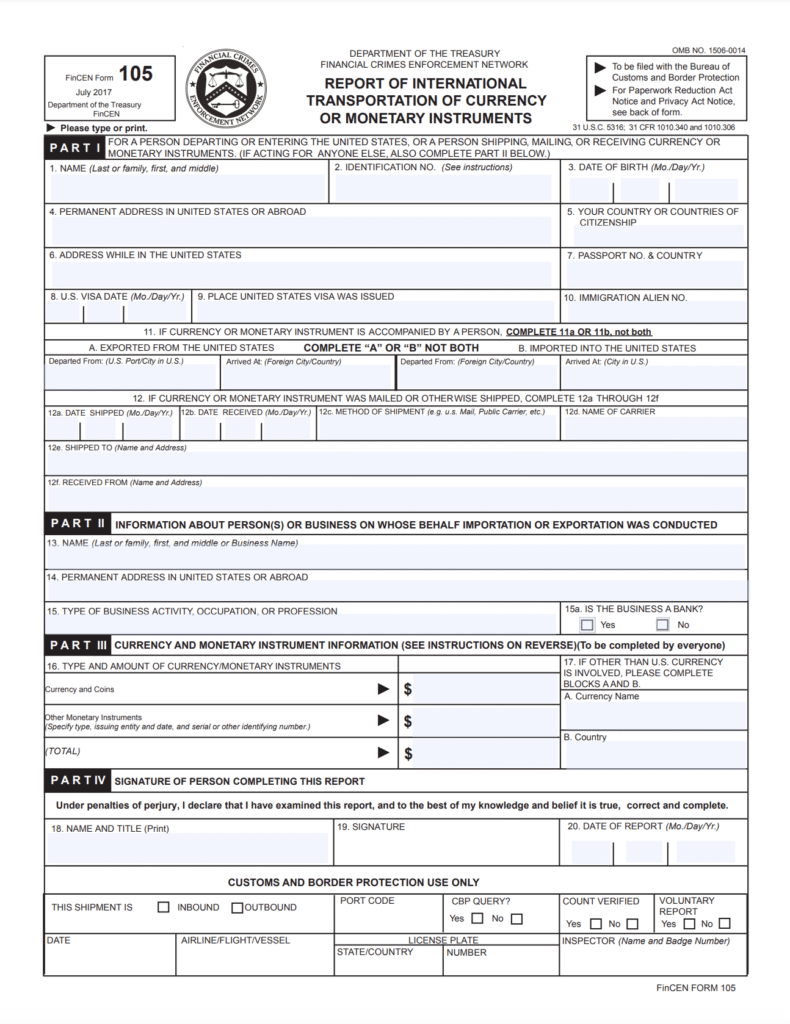

To declare currency, the bearer must complete a FinCEN Form 105, Report of International Transportation of Currency or Monetary Instruments. The FinCEN Form 105 is available from any U.S. Customs and Border Protection (CBP) officer.

When you complete the FinCEN Form 105, you must provide the following information:

- Your name and address,

- The date of your arrival in the United States,

- The value of currency or other monetary instruments you are bringing into the United States, and,

- The country from which you are bringing the currency or other monetary instruments.

Currency Declarations Apply to Families

When entering the United States, families residing in one household and submitting a joint declaration, must declare the aggregate value of their currency or monetary instruments when it meets or exceeds the $10,000 limit on their Customs Declaration Form (CBP Form 6059B).

In addition, if any one member of the family brings in more than $10,000, they must also file a separate FinCEN Form 105. In essence, families are prohibited from having one member carry currency or monetary instruments on behalf of another member to avoid the $10,000 reporting requirement.

What Are the Penalties for Not Declaring Currency?

Penalties for failing to declare currency may be significant. Any person or family found to be bringing undeclared currency into the United States, may be assessed a fine of up to $5,000 and/or imprisonment for up to five years.

Currency Transaction Reporting Rules Also Apply to Exports

International travelers leaving the United States, regardless of their citizenship, with currency or monetary instruments in a combined amount exceeding $10,000 are also required to file a FinCEN Form 105 prior to their time of departure.

Tips for Complying with the Currency Declaration Requirement

Maintain timely and accurate records of all monetary transactions to substantiate the value of currency you are bringing into the United States.

Declare all currency or other monetary instruments being brought into the United States. It is suggested to declare the transportation of currency even if the total value is less than $10,000.

Additional Considerations when Importing Currency to the United States from Mexico:

- Mexico is a high-risk country for money laundering.

- Travelers bringing currently into the United States from Mexico may be subject to additional scrutiny.

- Travelers from Mexico may be asked to provide additional information regarding the source of the currency, such as a bank statement or a letter from their employer, to legitimize the currency.

- Bringing currency into the United States for business purposes, may require the filing of additional paperwork.

Following the rules and the above tips may help ensure the proper disclosures and compliance with the U.S. currency rules and go a long way in avoiding serious penalties associated with non-compliance.

Should you have any questions regarding the transportation of currency and other monetary instruments, please reach out to the International Tax Attorneys at RJS LAW via the web or call 619-595-1655, for a free consultation.

Written by Andrea Cisneros Valdez, Esq., LL.M.

Leave a Reply