IRS Collection Financial Standards

The IRS recently released the new Collection Standards for 2023. The IRS Collection Financial Standards are significant because they often determine what a Taxpayer can “reasonably afford” when a Taxpayer makes a payment arrangement such as an Offer in Compromise, Currently Non-Collectable Status, or an Installment Agreement with the IRS for back taxes. The Collection Standards can determine whether a taxpayer qualifies for an Offer in Compromise, Currently Non-Collectable (CNC) status, and/or determine the terms of a Taxpayer’s installment agreement. Other taxing authorities including the Franchise Tax Board (FTB) look to the IRS Collection financial standards when determining what a Taxpayer can “afford” as well.

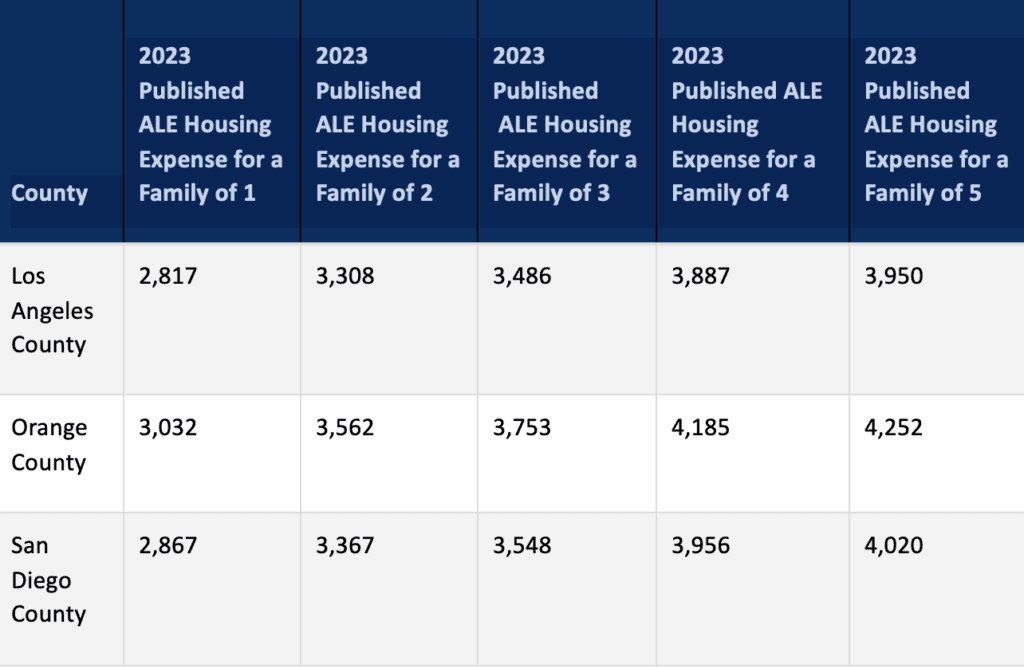

The Collection standards showed some increases over the 2022 standards to account for inflation. (Whether the increases in the 2023 standards are sufficient enough is certainly debatable.) The standards have always been unforgiving when it comes to allowances for housing and utilities. The table below summarizes the 2023 standards’ allowances for housing and utilities for three Southern California counties.

To give an example of how these collection standards work, let us say a couple in San Diego County with one child (a family of 3) owes back taxes to the IRS and they need to get on a monthly payment plan. The IRS will often base the payment plan on what the couple can “afford.” It will allow the couple $3,548 for housing and utilities which would include rent or mortgage, electricity, gas, water, trash, internet, telephone, home maintenance, property taxes, HOA fees, and several other housing related expenses. If the couple’s actual housing and utilities expenses exceed $3,548, the IRS will often not consider the excess expenses in determining what the couple can afford. The couple may be expected to somehow “downgrade” or cut their housing expenses to pay the IRS.

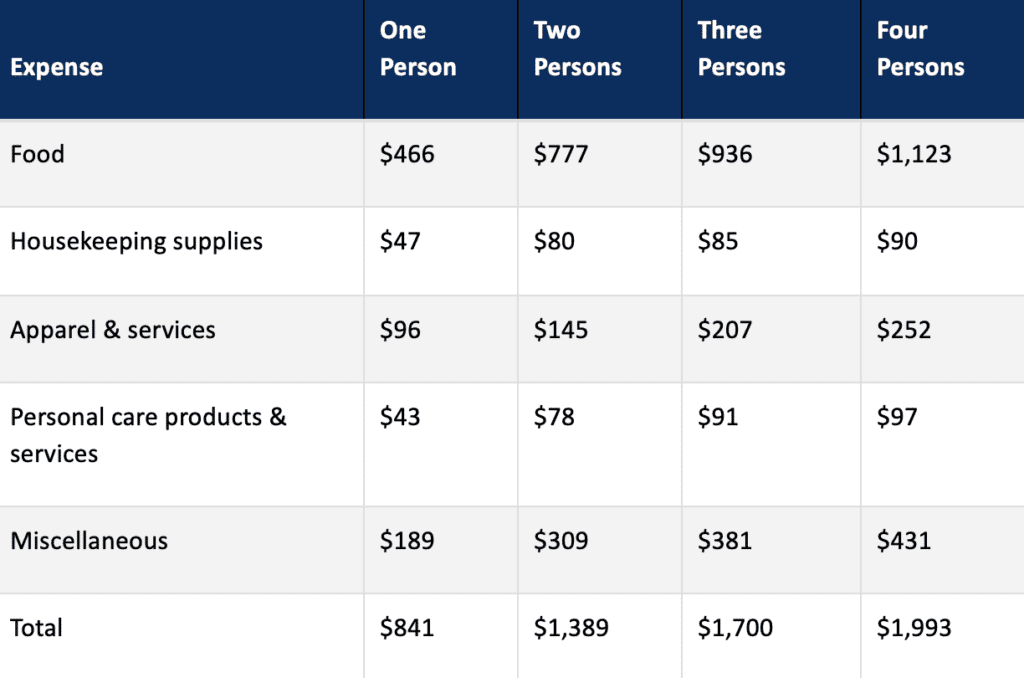

The IRS has similar standards for food, clothing, and transportation expenses. Some standards are the same nationwide. For example, taxpayers in all parts of the country are allowed the IRS standards for food, clothing, and other expenses listed below.

Housing and vehicle operation costs vary from locale to locale. As shown above, Taxpayers in different counties have different housing and utilities allowances. Taxpayers who reside in more expensive parts of the country like Southern California have a higher allowance than less expensive parts of the country. Taxpayers in different regions have different vehicle operating costs. Again, in certain regions of the country operating expenses like insurance and parking can be more expensive than in other regions.

The standards serve two purposes. First, they allow the IRS and taxpayers to streamline the collection process. It is usually easier for the Taxpayer and IRS to use standards for food expenses than for the IRS and taxpayers to parse through receipts and other records to substantiate expenses. Second, and most importantly, the standards are supposed to create a “reasonable” standard for determining what a taxpayer can truly “afford.” A taxpayer should not be able to claim he or she cannot afford to pay his or her past due taxes while living high on the hog. Whether the standards effectively accomplish the goal of creating a reasonable standard or whether they are too draconian is certainly debatable.

At RJS LAW, we help families and businesses with past due tax debts to navigate their way through the IRS Collection process. We also help families and businesses with EDD, Franchise Tax Board, and CDTFA collection issues as well. Please us today for a free consultation at 619-595-1655 or contact us on the web at RJS LAW if you are having difficulty paying your past due taxes.

Written by Joseph Cole, Esq., LL.M.

Leave a Reply