What is an Opportunity Zone?

The Opportunity Zone (“OZâ€) was originally discussed in Congress after the Great Recession of 2008, with an intent to lift Americans out of poverty and bring economic and community revitalization to the areas that were deeply affected by the 2008 economic downturn. Congress created section 1400Z under the 2017 Tax Cuts and Jobs Act (TCJA). President Trump created the White House Opportunity and Revitalization Council via Executive Order 13853 on December 12, 2018, to encourage public and private investment in urban and economically distressed areas, including Opportunity Zones.

Under the 2017 TCJA, Opportunity Zones comprise 8,764 census tracts, nominated by State and Territorial executives and certified by the U.S Department of the Treasury. Governors were allowed to nominate no more than 25% of their eligible low-income census tracts and no more than 5% of the eligible contiguous census tracts to be Opportunity Zones. The nomination process took place in the spring 2018, and the nominated census tracts were then certified by the IRS. The Opportunity Zone tax incentive is designed to spur economic development and job creation in these communities through preferential tax treatment for those investing certain eligible capital gains into Opportunity Zones through Qualified Opportunities Funds.

What is an Opportunity Fund?

To enjoy the tax benefits available under the Opportunity Zone legislation, a taxpayer must invest the applicable “gain†from a business sale or exchange into a “Qualified Opportunity Fund†(QOF) within 180 days of the transaction. If a successful investment is made, the taxpayer’s gross income for the taxable year shall not include the amount invested by the taxpayer. In addition, the taxpayer can potentially use other tax benefits including deferral of gain, favorable adjustments to tax basis at 5 and 7 years, and permanent exclusion of gain recognized on the sale of the investment in the QOF at 10 years.

How do the Opportunity Zone work?

The program provides three tax benefits for investing unrealized capital gains in Opportunity Zones:

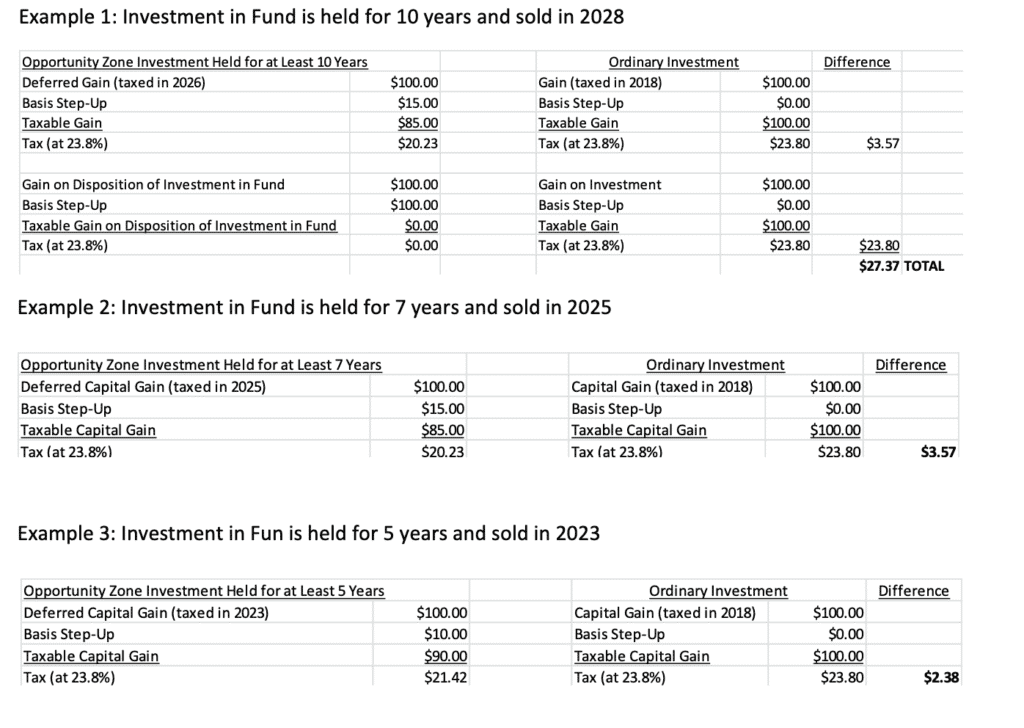

- Temporary deferral of taxes on previously earned capital gains: Investors can place existing assets with accumulated capital gains into opportunity funds. Those existing capital gains are not taxed until the end of 2026 or when the asset is disposed.

- Basis step-up of previously earned capital gains invested: For capital gains placed in Opportunity Funds for at least 5 years, investors’ basis on the original investment increases by 10%. If invested for at least 7 years, investors’ basis is increased by 15%.

- Permanent exclusion of taxable income on new gains: For investment held at least 10 years, investors pay no taxes on any gains on investments in Opportunity Funds which invests in Opportunity Zones.

Note that this non-recognition rule applies to all appreciation in the QOF investment but does not apply to the original deferred gain, which will be recognized no later than December 31, 2026, under the first rule noted above. Because the tax basis adjustment to fair market value is elective, a taxpayer selling at a loss can simply choose not to make this election and claim the full loss under the usual rules.

The following highly simplified examples illustrate the tax benefits of investing in a QOF. This example assumes that deferred gain is $100 and that appreciation in the QOF investment is also $100, which is not the same $100 of gain.

If only capital gain is invested into a QOF, the taxpayer initially has a tax basis of zero in the QOF. On the other hand, if the taxpayer invests non-gain funds into the QOF or borrows funds at the QOF level (assuming the QOF is a partnership) the taxpayer will have corresponding positive outside tax basis in the QOF interest prior to these further adjustments. If the investment is then maintained for five years, the outside tax basis of the taxpayer in the OZ fund is increased by an amount equal to 10% of the amount of the original deferred gain, and at seven years is adjusted by another 5% (to a total 15%).

Who can potentially benefit from Opportunity Zone?

- Individuals or corporations looking to reinvest gains from sales of property to defer and reduce taxes and/or to enjoy tax-free investment returns.

- Real estate developers and start-up companies located in an Opportunity Zone who are looking for equity investment; and

- Real estate sponsors, syndicators or private equity funds looking to create Opportunity Funds and then make investments in Qualified Opportunity Zone Property, including investments in corporations, partnerships or direct investments in property.

What are issues that Investors face?

Although the tax incentives are attractive, the Opportunity Zone can be astonishingly complicated, with many strange, exotic and unprecedented concepts. For example:

- A taxpayer can only invest funds from capital gains – not just excess cash.

- There are various deadlines within which cash must be moved from the taxpayer to the QOF to the QOZB and then expended.

- Investments in a QOF have zero outside tax basis but full inside tax basis, until basis adjustments occur.

- Businesses must be operated in a specific location, meet strict and complicated criteria and satisfy a variety of restrictions that may not necessarily make economic sense, but for the OZ tax incentive.

What is the business structure in Opportunity Zone?

Congress noted that QOZ land is zoned for two stories. This means that almost every eligible investment structure will have a Qualified Opportunity Fund (QOF) on top (where taxpayers invest capital gain) and a Qualified Opportunity Zone Business (QOZB) on the bottom, where the qualified business is operated. Both the QOF and QOZB must always be partnerships or corporations. It is possible, but very difficult, to operate a zone story arrangement where the QOF accepts gain and then operates the business. However, a QOF operating a business must meet the 90% Asset test meaning 90% of its assets are tangible property meeting the definition of Qualified Opportunity Zone Business property (QOZBP) and few modern businesses will have that percentage of tangible property (and no more than 10% of other assets).

QOZBP’s also have relatively detailed operating requirements that must be met and that generally connect the QOZB to the related Opportunity Zone. These include:

- Substantially all (70%) of the tangible property must be QOZBP (property acquired for use in the Zone);

- More than 50% of the gross income must be sourced to the Zone:

- A substantial (meaning 40%) portion of the intangible property must be used in the Zone; and,

- The business may not engage certain types of Zone related activities.

Are You Ready to Invest?

As noted above, these investments must be carefully planned, executed, and recorded to claim your tax advantages. RJS LAW is well versed and stands ready to counsel and work with you to achieve your investing goals.

IRS FAQ’s – Opportunity Zones Frequently Asked Questions

Published by Daniel Huynh

Leave a Reply